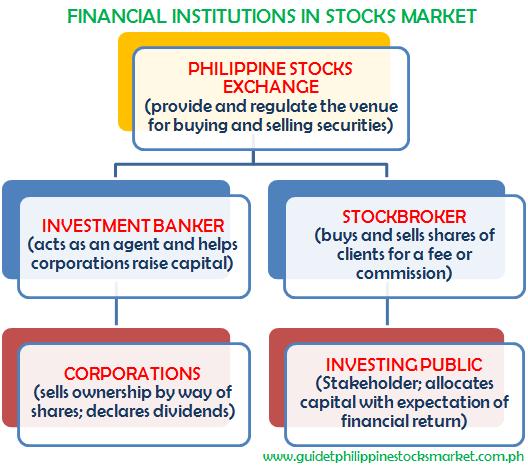

Last week we discussed how the stock market works and the roles of different financial institutions involved. For today, I want to show you how these institutions are connected and how it functions:

Corporations are the business that need to raise funds by making portions of their equity or debt securities available the investment public to buy.

The investment banker assists corporations, government or institutions in raising capital by underwriting or the client's agent in the issuance of securities.

The Philippine Stocks Exchange facilitates the trade and is primarily responsible for bringing all parties together.

The investing public allocates their capital expecting a financial return in the future. It can either be in a form of stocks appreciation, dividends, stock options and rights, warrants and other similar vehicles that generate profits.

The investment banker assists corporations, government or institutions in raising capital by underwriting or the client's agent in the issuance of securities.

The Philippine Stocks Exchange facilitates the trade and is primarily responsible for bringing all parties together.

The investing public allocates their capital expecting a financial return in the future. It can either be in a form of stocks appreciation, dividends, stock options and rights, warrants and other similar vehicles that generate profits.

The stockbroker serves as the middleman in completing the transactions between the investing public and the placements made by the investment banker in the stock exchange. Their income is primarily derived from fees and commissions.

Some of you may wonder why the corporations or investing public do not transact directly with the exchange. The need for "middlemen" such as investment bankers and stockbrokers actually offer these corporations and investors expertise and provide useful information that are otherwise very difficult to obtain. They can give relevant updates from the stocks exchange even before it is released in the media.

As you know, being always updated with the current news play a significant part of every trader or investor's success. Even a one-day delay can mean a big difference of making a profit or a loss.

You might also like:

Your Investment Timeline and Why You Should Start Early

Bulls And Bears

Trading vs Investing

Some of you may wonder why the corporations or investing public do not transact directly with the exchange. The need for "middlemen" such as investment bankers and stockbrokers actually offer these corporations and investors expertise and provide useful information that are otherwise very difficult to obtain. They can give relevant updates from the stocks exchange even before it is released in the media.

As you know, being always updated with the current news play a significant part of every trader or investor's success. Even a one-day delay can mean a big difference of making a profit or a loss.

You might also like:

Your Investment Timeline and Why You Should Start Early

Bulls And Bears

Trading vs Investing